Sundaram ELSS Tax Saver Fund Regular Growth

Invest Now

Fund Manager: FM1- Sudhir Kedia; FM2 - Mr. Rohit Seksaria |

Equity: ELSS |

NIFTY 500 TRI

522.4558

-6.53

(-1.25 %)

NAV as on 08-01-2026

141.08 Cr

AUM as on

Fund House: Sundaram Mutual Fund

Rtn ( Since Inception )

14.2%

Inception Date

Jan 01, 2013

Expense Ratio

2.21%

Fund Status

Open Ended Scheme

Min. Investment

500

Min. Topup

500

Min. SIP Amount

500

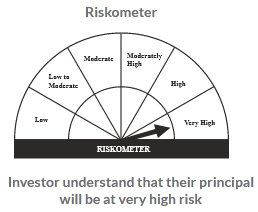

Risk Status

very high

Investment Objective : To build a high quality growth-oriented portfolio to provide long-term capital gains to the investors. The scheme aims at providing returns through capital appreciation.